- As Seen On:

Scroll to view

The pivot points are available 24/7 to our members. Please register or login, goto the My Stocks Tab, add your stocks, and you'll get all the plans for all the stocks on your list with one click thereafter. We have made it easy for you.

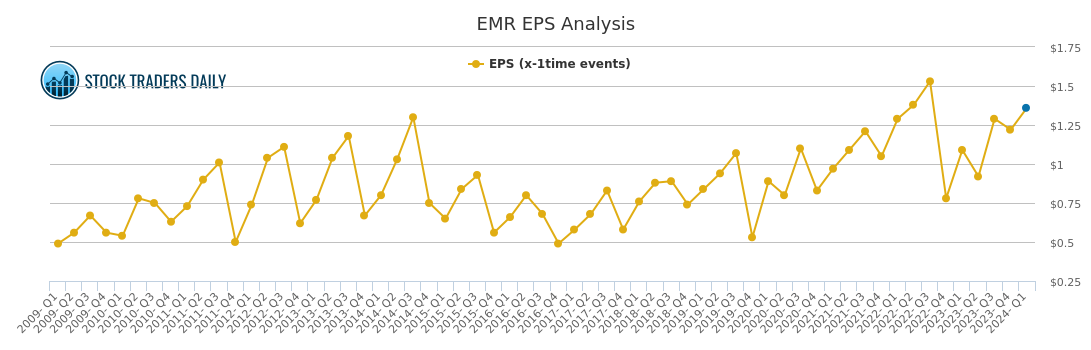

Accurate! See how accurate our pivot points for EMR are by applying the simple rules of T/A (e.g., buy near support – target resistance)

to the past EMR articles we have published. These include rules-based trading plans for EMR.

We publish public articles on most stocks once every 10-days.

Of course, we update our data in real time for Members, but you can still use the pubic data for evaluation. Do the backtesting by opening a

past article, review the trading plans in that article, then open a graph of EMR and see how the plans would have done.

Or, the easier way is to become a member and watch it live (pay attention). You’ll like what you see. Our SPY and QQQ pivots are great.

Use the trial link on this page to sign up, or click a menu item to login.

Protection from Market Crashes: We help investors do this with our Evitar Corte Model. It identified every crash since 2000, in advance.

The IR is a measure of NATURAL LIQUIDITY. The IR identified the bookends of every long term stock market cycle since 1900.

With a macro foundation (broad analysis), we offer actionable investment strategies that allow clients to make money in any market environment.