What is a PE Ratio?

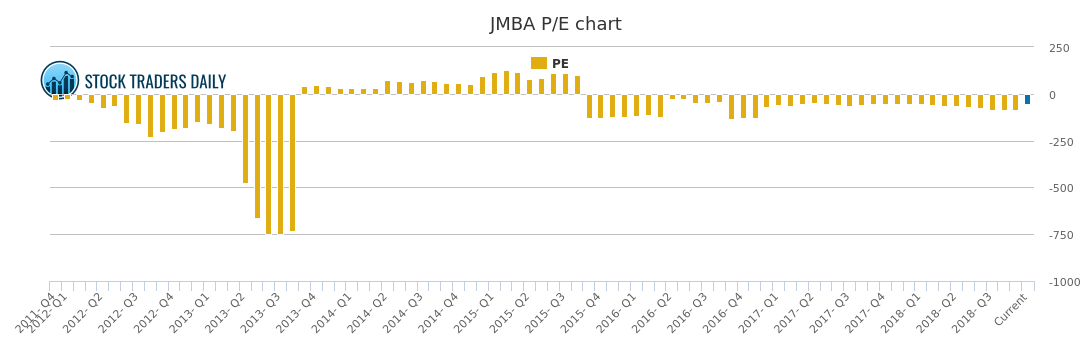

The PE Ratio chart for Jamba (JMBA) is a valuation observation.

A PE Ratio is a price to earnings ratio that has historically helped investors define fair value. This is often referred to as the multiple of a stock, and when groups, markets, or sectors are defined the multiples of all the stocks in those groups can be averaged to define average PE multiples as well.

Average PE multiples have been popularized in recent years because historical comparisons make current valuations look stretched. Instead of comparing historical averages, investors today use peer groups to compare PE multiples for individual companies because those stocks often trade in the higher PE spectrum that exists in today’s environment.

However, the fact remains that a PE ratio reveals how much an investor is willing to pay for the earnings of a company at any given time. The higher the PE multiple the more expensive a company may be, but that is not always true. The PE ratio simply reveals how many times earnings an investor is willing to pay, or that a shareholder is willing to maintain. The PE Ratio alone does not reveal fair value.

Fair value is what someone is willing to pay, they say, and that is true, but in a time of free money and stimulus the willingness to pay more may also be skewed. Multiples can increase based on fabricated demand even if earnings growth does not warrant the higher valuation levels.

PE ratios still provide comps to peer groups, but they do not represent free market fair value anymore.

How is the Price to Earnings (PE) Ratio Calculated?

The PE Ratio = (Per Share Stock Price/EPS)