What is EPS (Earnings per Share)?

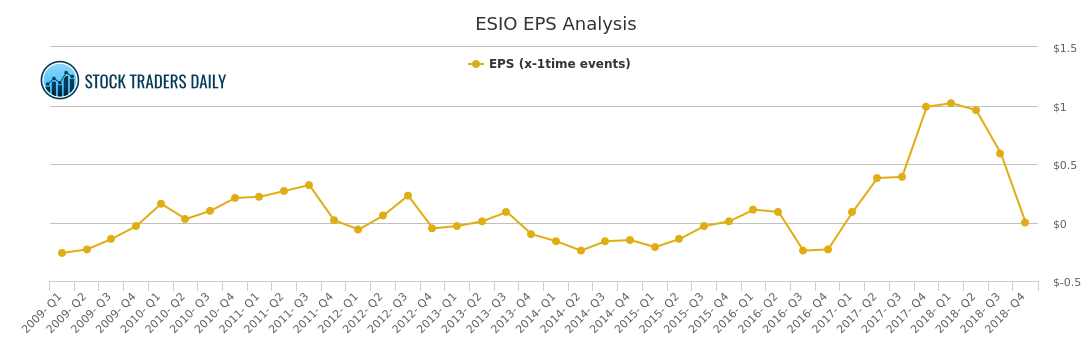

The EPS for Electro Scientific Industries (ESIO) helps us define growth rates over time.

EPS stands for Earnings Per Share, and our method of evaluating EPS purposefully includes EPS results from the past twelve months. This is also known as a Trailing Twelve Month (TTM) observation, and it is used to smooth seasonal EPS skews.

The EPS changes over time represent the growth of the company, after all expenses. This data can define a company’s ability to bring sales to the bottom line, and ultimately set the stage for fair valuation analysis as well.

Often, the EPS offered by a company further demonstrates a company’s ability to reward shareholders with dividends, increased cash per share, shareholder buybacks, acquisitions, and expansion. The general rule of thumb is that the better the growth rate in EPS, the more vibrant the company.

However, most companies experience ebbs and flows in EPS growth over time, so we encourage everyone to look at the longer-term trends, and if there are current divergences to evaluate the causality in an acute fashion before reaching conclusions. Temporary declines to EPS could be the result of a one-time event, or part of the company’s growth plans, and may not be net negative.

Here is how EPS is calculated:

EPS = Net Earnings /Shares Outstanding. Earnings per share is calculated by dividing the income attributable to common shareholders by the total number of shares outstanding for the period in question. .