|

Our Market Analysis

has one main objective, to keep our clients

ahead of the curve at all times. We watch

the Market tirelessly, it is our passion, and we

turn that zest for understanding into

forecasting models that allow you to further

your unique goals and ambitions.

We offer updated

Market analysis every day. These include

interpretations of current and future Market

action and surveys of trader sentiment.

But it doesn't stop

there.

Topics:

-

Market action

-

Trader

Sentiment

-

Updates and

Analysis

-

Give it a Try

Market Action:

The only way to get

a good feel for the current state of the Market

is to pay close attention to it. Every

day, an end of the day Market review will fail

to disclose many important occurrences that

happened during the session.

We pay attention to

detail. We watch the Market's action

closely, we notice changes and fluctuations

which appear abnormal, we identify

opportunities, and we include them in our

conclusions.

Our Market Analysis

is not a simple end of the day summary, it is

much more detailed. It includes

interpretations of the Market's action as it

relates to future Market cycles and that allows

us to forecast trend much more accurately than

our competitors.

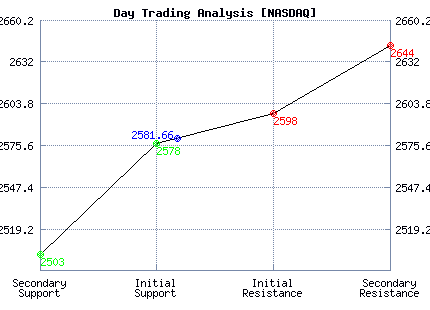

For example, here's

our daily Market Analysis on September 17:

Example from 9.17.07

Expect the

market to begin the day within a relatively

tight initial trading channel as it opens on

Tuesday. The market is likely to

flounder within the initial channel for the

better part of the day. However, a

break below support or above resistance is

likely to influence momentum market moves in

the direction of the break. The most

likely scenario is for a break below

support. If 2578 breaks lower expect

2503. However, if 2598 breaks higher

instead expect the market to surge to 2644

before it stalls. Be ready for moves

in either direction, just in case, as

always, but a break below support and

further declines is much more probable.

|

Initial intraday trading

parameters for the NASDAQ exist between

2578 - 2598 |

|

If 2578 breaks

lower expect 2503 |

|

If

2598 breaks higher expect

2644 |

|

2515 expect

2578 - 2598 to hold

|

|

Trader Sentiment:

We cater to traders

and investors, and we have our fingers on the

pulse of this demographic. We pay very

close attention to trader sentiment, and we

report changes in sentiment to you accordingly.

The sentiment of

Wall Street plays a critical role in Market

cycles. Trader sentiment can and will

influence the severity of a decline, or the

aggressiveness of an increase. It will

cause some news to seem more influential that it

should, others nullified.

Sentiment helps you

understand why.

Our analysis of

Trader Sentiment allows you to keep you fingers

of the pulse of Wall Street too, so you can

anticipate Market reactions to news and events

much more efficiently than you might otherwise.

Updates and Analysis:

We offer updates to

our Market Analysis every night. The

updates are offered in advance of the next

trading session. Typically updates will be

ready before 10:30 PM ET.

Included in the

analysis are:

The principle

version of this analysis is offered directly

through our website. Through our nightly

newsletter we provide concise reads on the

Market. This is a no-frills venue for this

information. It is clean, formatted, and

free of jargon or banter.

We also package

this same analysis in a .pdf version, and we

send that to you every night at midnight ET.

This is a different version of the same

information contained on our website; it does

not require you to go directly to the site.

Then the gloves come off.

Our Chief

Investment Officer sends a nightly email to our

subscribers with much more revealing

information. He includes personal

commentary, easy to read pivot charts, a list of

stocks which look good to trade, and detailed

trading plans for the next trading session.

The nightly email

from our Chief Investment Officer is a straight

forward review of the Market and it allows you

to prepare for trading opportunities well in

advance. It is easy to read, direct, and

easy to use.

With his gloves

off, he tells you what he thinks of the Market,

he tells you where he thinks the Market is

headed, and he tells you what he thinks Traders

should be doing to take advantage of it.

Although

explanations will be included in his nightly

email from time to time, the email from our

Chief Investment Officer is not intended to

provide detailed explanations of why he thinks

what he thinks; those details are found on the

website. He just tells you what to prepare

for, and how to make money from it.

Here's an example

from 9.17.07 (this is an excerpt):

|

Example from

9.17.07

Commentary:

By now you already are aware that there

is plenty to be looking out for on

Tuesday beyond the FOMC meeting. The

FOMC meeting, in fact, although it is

the most anticipated news of the day,

may turn out to be far less important

than the Financial Earnings releases

coming this week. We won't know for

sure until after the dust settles, but

my anticipation is that the FOMC

decision will not be as important.

I have already illustrated my points of

view on the FOMC through my blog. I

hope you have had time to review it. If

not, do so immediately

http://stocktradersdaily.com/clubsite/Club/blogs/

Also, remember that the Market has

followed the trend of Interest rates

since 2000. When Interest Rates have

been declining so has the Market, and

vice versa. You can find evidence of

this in my past blogs as well. These

comments are under the Economics

Category.

Be ready for volatility on Tuesday; the

eventual direction is most likely down. |

Give it a try:

|

|

Free 10

Day Trial - Platinum Membership

Sign Up Now

You can cancel at any time and won't be charged

All of our services are

included in the Free Trial.

Instructions:

- Click the Sign Up Link below to start your Free Trial

- Record your username and password.

- Use the Platinum Login to enter the Clubsite.

- Your Free Trial lasts for 10 Calendar Days

- The service is $299 per month after 10 Days.

|

|

|