|

For June 11, 2010

(Individual Chart Analysis)

This is a no-frills analysis. It is not designed

to look good, it is designed to be effective.

Summary of the Technical Analysis for the DOW

(This takes into account the near term, mid term, and

longer term charts)

our combined analysis for Friday tells us to

expect the market to begin the day with a bias to increase. Overall, our

combined analysis is bullish. The longer-term charts are bullish, midterm

support levels have held, and the near-term charts shows is that breakouts have

already begun to occur. Combined, there is a bullish read stemming from

our analysis for Friday. If the market begins the day with a bias to

increase and if it holds above initial support levels, aggressive market

increases can follow. At least, midterm neutral resistance levels can be

tested. If this occurs it should be considered a test of inflection, but

midterm resistance is nicely higher than the close of the market on Thursday, so

such a move would also be construed as relatively bullish. Treat initial

support as inflection for Friday's trading session, and use it to guide your

decisions accordingly. If 10065 remains in tact as support expect the

market to increase to 10316. However, if 10065 breaks lower, expect 9869

instead.

|

Initial intraday trading parameters for the DOW

exist between 10065 and 10316 |

|

If

10065 breaks lower expect

9869 |

|

If 10316 breaks higher

expect 10908 |

|

Otherwise expect 10065 - 10316 |

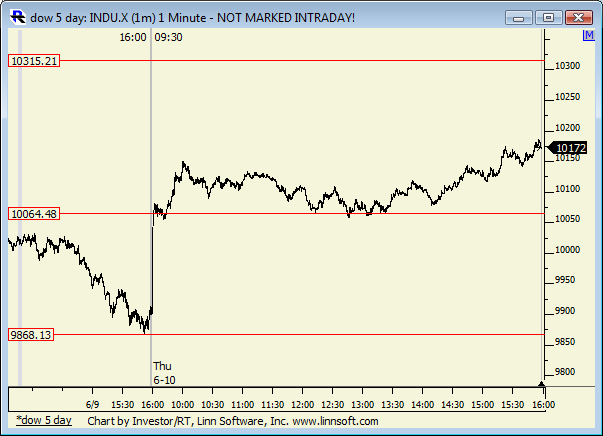

Near Term Chart Analysis for the DOW

Our combined

near-term analysis tells us the market is in a near-term neutral trading

channel. In addition, it tells us that the market has recently broken

above the neutral intra-channel resistance line that had been in tact.

This former level of resistance has since been converted into support and it is

inflection. If recently converted near term neutral intra-channel support

remains in tact expect the market to begin the day with a bias to increase on

Friday and expect a test of near term neutral resistance to follow.

Near Term Support for the DOW exists at 10065 then

9869

Near Term Resistance for the DOW exists at

10315

Mid Term Chart Analysis for the DOW

Support is holding, for

now...

Our combined midterm

analysis tells us that the neutral mid term channel that we have been watching

is likely to solidify soon. Specifically, midterm neutral resistance is

likely to be tested soon, and that will confirm the channel again.

According to our combined midterm analysis, support levels have held thus far.

If those support levels continue to hold, and because the market has already

begun to pull away, expect a test of resistance to follow. Appropriately,

our combined midterm analysis tells us to expect a test of midterm neutral

resistance levels soon. If/when that happens, treat resistance as

inflection.

Mid Term Support for the DOW exists at 9789

Mid Term Resistance for the DOW exists at 10319

then 10908

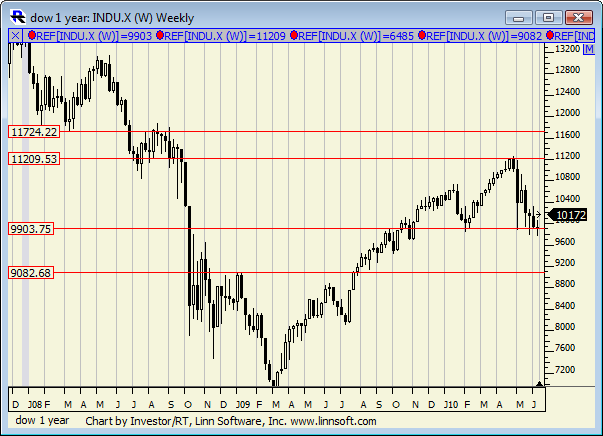

Longer Term Chart Analysis for the DOW

Our combined longer term

analysis tells us that the Market is threatening to

break longer term neutral support. This, when

combined with the reversal confirmation we pinpointed in

late April, suggests that aggressive breaks are likely

at some point. Treat support as inflection,

recognize that some markets have started to break below

longer term neutral support already, and prepare for

additional declines at some point as a result. A

slight bounce back is not uncommon, but the breach that

is obvious from some of the Markets we follow suggests

that an eventual turn lower should come. This sets

the stage for our longer term plans.

Longer Term Support for the DOW exists at 9904

Longer Term Resistance for the DOW exists at 11209

|